安全2.0使给予和接受更容易

They say it’s better to give than to receive, but doing both while reducing your income tax liability may be appealing. 安全的2.0的行为, included in the federal spending bill passed in late 2022, created two new giving opportunities that could do just that.

The new provision modifies the rules for qualified charitable distributions (QCDs), which allow a taxpayer who is age 70½ or older to contribute up to $100,000 annually — indexed for inflation — from a traditional IRA to a qualified public charity. 2024年的限额是10.5万美元. While the contribution is not tax-deductible, the distribution — which would normally be subject to ordinary income tax — is not taxable. And the QCD can satisfy all or part of your required minimum distribution, which might otherwise increase your taxable income.

根据新规定, 最高50美元,000 of one year’s QCD limit — also indexed for inflation — can be used to fund a charitable gift annuity (CGA) or a charitable remainder trust (CRT), either of which could provide a lifetime income in return for the gift. 2024年的上限是5.3万美元. The option can only be used once in your lifetime, but multiple gifts can be made in the same year, 直到寿命限制. Your spouse can also use the lifetime limit, so a couple could make up to a $106,000 bequest in 2024.

慈善捐赠年金

A charitable gift annuity is a contract between you and a charitable organization that generally guarantees a fixed payment in return for the bequest. 可以按月付款, 季度, 每半年, 或每年, and extend for the lifetime of the beneficiary(ies). These annuities are not new, but they previously could not be funded from an IRA. CGAs are commonly offered by colleges and universities, as well as by many other organizations.

慈善剩余信托

When you place assets in a charitable remainder trust, you designate an income beneficiary or beneficiaries to receive specified payments for a term of up to 20 years or for the lifetime of the beneficiary(ies). Income payments must be made at least once a year and may be fixed or variable depending on the type of CRT. Upon the end of the term or the death of the beneficiary(ies), the assets in the trust go to the charity.

潜在的支出

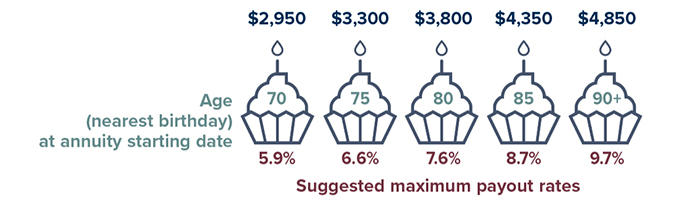

These are sample annual payouts for one individual from a $50,000礼品年金, based on suggested 2023 maximum rates from the American Council on Gift Annuities. Actual payouts may differ, and rates can change with economic conditions. Payouts for two people depend on both ages.

Source: American Council on Gift Annuities, 2023

QCD机会的规则

Funding a CGA or CRT from sources outside your IRA has more flexible rules. 例如, you can gift highly appreciated assets such as stocks — which could have other tax benefits — and you can designate a beneficiary other than you or your spouse. 对于QCD选项, the funds must be distributed directly from the IRA trustee to the CGA or CRT, and the beneficiary(ies) must be you or you and your spouse. 以下是其他一些关键点.

- 最低支付率为5%. The CRT maximum rate is generally 50%; maximum CGA rates generally target a residual value of at least 50%. Payouts must begin less than one year after making the bequest.

- Although the contribution is not tax-deductible, it must pass the 10% test for tax-deductible contributions, meaning the charitable value must be more than 10% of the contribution.

- All payments are taxable at the recipient’s ordinary income tax rate.

- Only a new CRT can be funded by the QCD option, and a QCD-funded CRT cannot receive other funding from the IRA or other donated assets.

Although payments from a CGA or CRT are guaranteed under the terms of the contract, the guarantee depends on the strength of the charitable organization. 如果你选择资助CRT, keep in mind that the use of trusts involves a complex web of tax rules and regulations, and there are initial costs and ongoing expenses. You should consider the counsel of experienced estate planning, 法律, and tax professionals before implementing trust strategies or funding a gift annuity.