It’s not easy to keep up with complex tax laws that always seem to be changing, 更不用说弄清楚它们对你个人的影响了. 即便如此, it’s important to consider the potential impact of taxes when making many types of financial decisions.

The IRS automatically adjusts the standard deduction and income tax brackets annually for inflation. 2022年,通货膨胀率升至40年来的最高水平, so the 7% increases for 2023 are the largest since these adjustments began in 1985.1 标准扣除额是13美元,2023年,单一申请者的费用为850美元(比2022年增加900美元),27美元,已婚共同申报人700美元(上涨1美元),800).

The filing deadline for 2023 federal income tax returns is April 15, 2024, 4月17日,缅因州和马萨诸塞州, 由于当地假期). 尽管2024纳税年度正在顺利进行, there may still be time to take steps that lower your tax liability for 2023.

了解“边际”税率

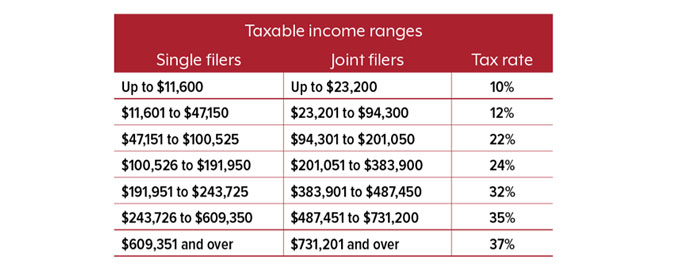

U.S. tax rates increase at progressively higher income levels or brackets (see table). If your taxable income goes up and moves you into a higher bracket, the resulting tax increase might not be as bad as it may appear at f国税局t glance. 例如, if you and your spouse are filing jointly for 2023 and have a taxable income of $110,000, 你的税率是22%. However, you will not pay a 22% rate on all of your income, only on the amount over $94,300.

Determining the value of certain deductions also depends on where your income falls in the tax brackets. 用同样的例子, a $10,扣除额将使你的收入从110美元减少,000 to $100,000美元,理论上可以减少2美元的纳税义务,200 (22% x $10,000). 20美元,000年扣除, you would have to calculate the amount of the deduction that falls in the 22% and 12% brackets: 22% x $15,700 + 12% x $4,300 ($3,454 + $516 = $3,970).

虽然知道边际利率是有帮助的, your effective tax rate — the average rate at which your income is taxed (determined by dividing your total taxes by taxable income) — may offer a better way to gauge your tax liability.

2024年联邦所得税等级

资料来源:美国国税局,2023年

扣除重大伤亡损失

野火、龙卷风、强风暴、洪水、山体滑坡. The United States was struck by a record number of billion-dollar catastrophes in 2023.2 如果你拥有的东西在灾难中被损坏或摧毁, and your loss exceeds 10% of your adjusted gross income (AGI) plus $100, you may be able to claim an itemized deduction on your federal income tax return. This typically applies to large losses that are uninsured or subject to a high deductible. 2018年至2025年, a personal casualty loss is deductible only if it is attributable to a federally declared disaster.

有关伤亡损失的规定可能很复杂. If you have suffered a significant loss, it may be worthwhile to consult a tax professional.

申请延期

如果你因为任何原因不能在截止日期前提交申请, you can file for and obtain an automatic six-month extension using IRS Form 4868. (Otherwise, if you owe taxes, you might face a failure-to-file penalty.) You must file for an extension by the original due date for your return. For most individuals, that’s April 15, 2024; the deadline for extended returns is October 15, 2024.

An extension to file your tax return does not postpone payment of taxes. Estimate your tax liability and pay the amount you expect to owe by the original due date. Any taxes not paid on time will be subject to interest and possible penalties.

给自己发工资

Making deductible contributions for 2023 to a traditional IRA and/or an existing qualified health savings account (HSA) could lower your tax bill and pad your savings. If eligible, you can contribute to your accounts up to the April 15, 2024, tax deadline.

2023年的个人退休账户缴款限额为6500美元(2024年为7000美元)。. If you’re 50 or older, you can make an additional $1,000 catch-up contribution. 如果你或你的配偶在工作中有退休计划, eligibility to deduct contributions phases out at higher income levels.

如果你在2023年参加了符合hsa条件的健康计划, 你最多可以捐款3美元,个人保险850美元或7美元,家庭保险750元. (2024年的限额分别为4150美元和8300美元.) Each eligible spouse who is 55 or older (but not enrolled in Medicare) can contribute an additional $1,000.

避免诈骗和代价高昂的错误

Tax season is prime time for identity thieves who may fraudulently file a tax return in your name and claim a refund — which could delay any refund owed to you. Or you might receive threatening phone calls or emails from scammers posing as the IRS and demanding payment. Remember that the IRS will never initiate contact with you by email to request personal or financial information, and will never call you about taxes owed without sending a bill in the mail. 如果你认为你可能欠税,直接联系国税局 国税局.政府.

美国国税局检查了不到0个.占近年来所有个人回报的5%, but the agency has stated plans to increase audits on high-income taxpayers and large businesses to help recover lost tax revenue. Wherever your income falls, you probably don’t want to call attention to your return.3 再次检查你手工计算的结果. If you use tax software, scan the entries to make sure the math and other information are accurate. Be sure to enter all income, and use good judgment in taking deductions. 保存所有必要的记录.

最后, if you have questions regarding your individual circumstances and/or are not comfortable preparing your own return, 考虑与经验丰富的税务专家合作.

税务季节新闻和生存提示

税务季节新闻和生存提示